|

Only have a minute? Listen instead |

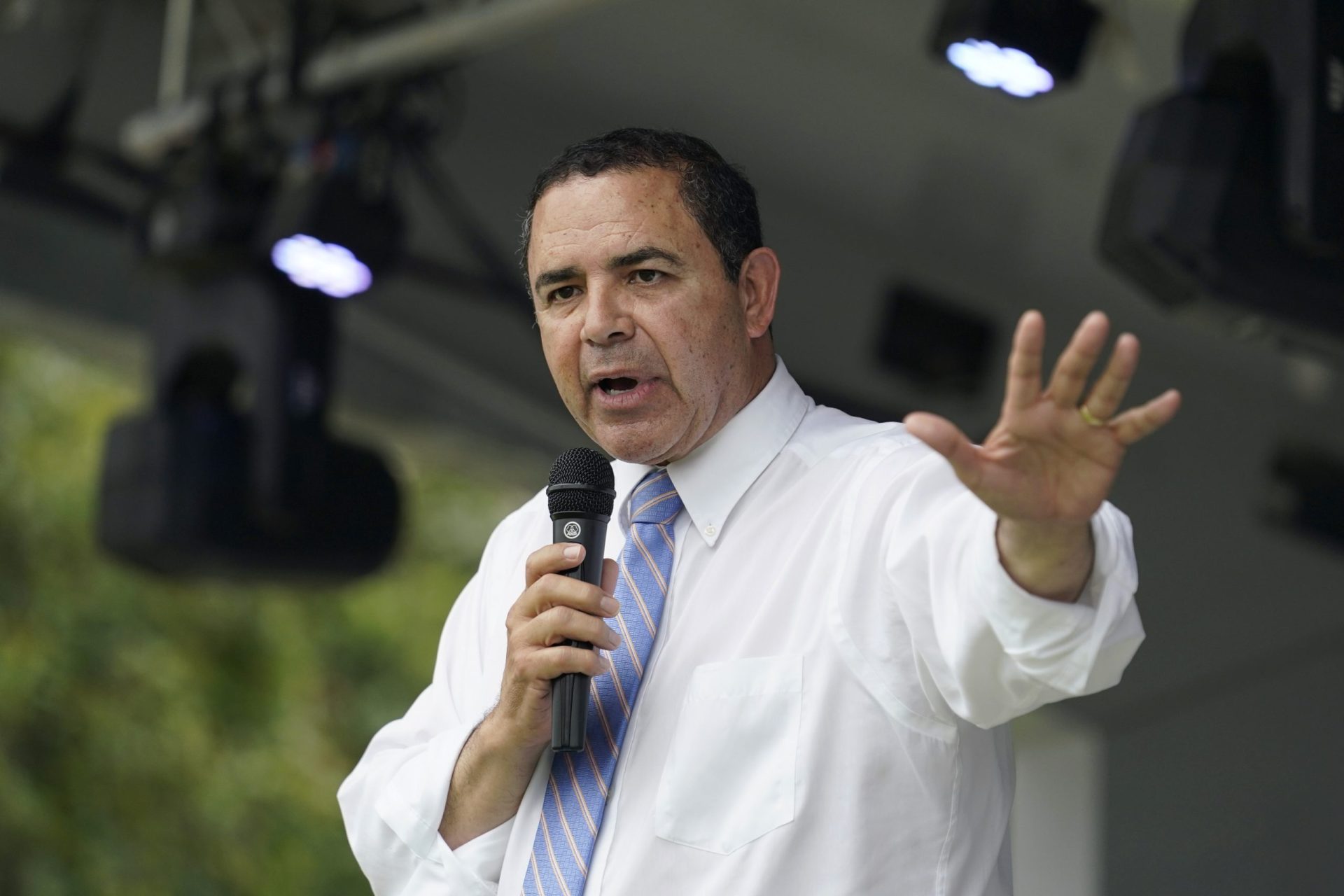

While federal prosecutors accuse U.S. Rep. Henry Cuellar, D-Laredo, of taking bribes to further the interests of the former Soviet republic of Azerbaijan, they also accuse him of taking bribes from a bank headquartered in Mexico City.

Authorities unsealed a 54-page indictment against Henry Cuellar and his wife Imelda Cuellar on Friday, accusing them of scathing accusations that they accepted nearly $600,000 in bribes from a foreign oil company in Azerbaijan, which was laundered through shell companies controlled by Imelda Cuellar from December 2014 to at least November 2021.

The prosecutors also allege that the Cuellars took bribes from a bank headquartered in Mexico City to influence financial policy beneficial to that company.

The Cuellars are each charged with two counts of conspiracy to commit bribery of a federal official; two counts of bribery of a federal official; two counts of conspiracy to commit honest services wire fraud; two counts of violating the ban on public officials acting as agents of a foreign principal; one count of conspiracy to commit concealment money laundering; and five counts of money laundering.

The Cuellars, who made an initial appearance in Houston federal court on Friday, deny the charges.

In a statement, Henry Cuellar called the allegations against his wife, who is accused of taking the bribes through sham consulting contracts, “wrong and offensive.”

“Imelda and I have been married for 32 years. On top of being an amazing wife and mother, she’s an accomplished businesswoman with two degrees,” the statement reads. “She spent her career working with banking, tax, and consulting. The allegation that she is anything but qualified and hard working is both wrong and offensive.”

THE BANK

The indictment said that the bank in Mexico City served low-income sectors of Central America and Mexico.

“It was owned by Mexican Company-1, a Mexican finance and retail holding company. Mexican Company-1, in turn, was a member of Mexican Conglomerate-1, a Mexican corporate conglomerate,” the indictment states.

The indictment also said a Spanish-language media and entertainment company based in Los Angeles, that was a member of Mexican Conglomerate-1, and a payday lending company that was a subsidiary of Mexican Company-1, were also connected to the alleged scheme.

Foreign Bank-1 was concerned about efforts in 2012 by U.S. regulators who were increasing enforcement of the Bank Secrecy Act and other anti-money laundering laws and regulations.

“This increase in regulatory oversight prompted some U.S. financial institutions to limit or withdraw from correspondent banking relationships with financial institutions in countries perceived to pose a high risk of money-laundering activity, including Mexico,” the indictment stated.

This is called de-risking, which “was of great concern to Foreign Bank-1.”

In May 2014 — when Henry and Imelda Cuellar were negotiating an alleged sham contract with the Azerbaijan oil company — they negotiated a “similar corrupt agreement” with the bank and with a Mexican politician who was an associate of Henry Cuellar who acted as an intermediary.

“From 2012 through 2015, Mexican Official-1 served in the Chamber of Deputies, the lower house of the Mexican Congress, representing a district within the State of Nuevo Leon. After Mexican Official-1’s term as a Deputy, Mexican Official-1 held various positions with the state of Nuevo Leon,” the indictment states.

Federal prosecutors allege that the “sham consulting contract” resulted in a payment of $236,390 to Henry Cuellar through one of Imelda Cuellar’s shell companies that was “funneled through multiple layers of middlemen and related entities.”

Much like the Azerbaijani contracts, Imelda Cuellar was listed as a consultant.

In December 2014, the indictment said that Henry and Imelda Cuellar traveled to Mexico where they met with the bank’s vice chairman to discuss the contract where the Los Angeles-based media company was added as the counterparty to the contract.

“Other terms, such as the contract term and the compensation, remained blank,” the indictment states.

By January 2015, the Los Angeles-based media company agreed to pay Imelda Cuellar’s shell company $12,000 a month for “strategic consulting and advising services” for two years.

“From March 5 to 8, 2015, Henry Cuellar and Mexican Official-1 exchanged messages about finding another middleman to further disguise the bribe payments,” the indictment states. “In one message, Mexican Official-1 told Henry Cuellar that ‘we need to find another scheme for [Foreign Bank-1]’ because entering the contract directly with Shell Company-1 was ‘not recommended.’”

When the Mexican official suggested a Mexican company, Henry Cuellar responded: “Prefer American.”

THE MIDDLEMAN

On Oct. 14, 2015, Henry Cuellar met with a longtime associate, Individual-3, who owned two Texas-based consulting companies, for breakfast at a hotel in Mexico City.

“At the meeting, Henry Cuellar recruited Individual-3 to serve as a U.S.-based middleman to further disguise and legitimate the bribe payments,” the indictment states.

Following the meeting, Henry Cuellar texted his associate’s contact information to the vice chairman of the Mexican bank to contact the associate about the contract.

That meeting happened over breakfast in Mexico City on Oct. 16, 2015.

The next day, prosecutors said Henry Cuellar texted Mexican Official-1 that the contract would move with an American company.

That contract would be $12,000 per month and Henry Cuellar directed Individual-3 to pay Imelda Cuellar $10,000 per month from those funds, according to the indictment.

“Henry Cuellar also told Individual-3 to ‘take care of’ Mexican Official-1 for facilitating the agreement with Foreign Bank-1,” the indictment states.

However, Henry Cuellar’s associate said “it was not a good idea to pay Imelda Cuellar directly.”

“Henry Cuellar suggested that Individual-3 pay Henry Cuellar’s campaign manager, Individual-4, and Individual-4 would, in turn, pay Imelda Cuellar,” the indictment states. “Henry Cuellar explained to Individual-3 that for their trouble, Individual-3 and Individual-4 would each get $1,000 per month,” the indictment states.

Henry Cuellar’s longtime associate agreed, but wanted more and at the direction of the congressman, negotiated a contract with the bank’s vice chairman that increased the consulting fee to $15,000 per month.

Imelda Cuellar’s work was never discussed, according to the indictment. The contract was signed on Jan. 11, 2016.

Eventually, Henry Cuellar’s campaign manager at the time acted as another middleman, though that individual believed they were involved with a project to test fuel lubricant produced by Mexican Company-2, according to prosecutors.

“Individual-3 offered to pay Individual-4 $11,000 per month conditioned on Individual-4 making $10,000 monthly payments to Imelda Cuellar,” the indictment states.

That document describes how Imelda Cuellar allegedly sent Individual-4 two falsified invoices for $10,000 with the description “Project management fee.”

The indictment also alleges that in 2021 the scheme continued with Individual-3 hiring one of his adult children over a consulting agreement between that relative’s shell company.

INFLUENCING POLICY

While federal prosecutors say Imelda Cuellar performed no legitimate work for the payments, they allege Henry Cuellar agreed to perform official acts on behalf of the Mexican bank.

That activity included legislative activity and regulatory and enforcement issues impacting the bank’s ability to access cross-border banking relationships, legislation blocking regulations that were bad for the payday lending industry, and legislation about cross-border electronic transfers.

On Jan. 9, 2015, Henry Cuellar emailed the bank’s vice chairman that he met with U.S. Official-2, a high-ranking member of the U.S. Executive Branch.

“The email attached a memorandum discussing the importance of correspondent banking relationships between U.S. and Mexican banks and urging policy action to promote such relationships, which were important to Foreign Bank-1’s business,” the indictment states.

He also asked for the executive’s input on a draft committee report highlighting de-risking problems “and directed the Department of the Treasury to ‘work with federal banking regulators’ to ‘set up a regulatory framework to ensure that legitimate financial transactions are able to take place.’”

When Henry Cuellar got the input, prosecutors said he added it to the draft and promised to submit it to the committee. He further promised to try to add the language to two different bills.

He is also accused of pushing the Consumer Protection and Choice Act in 2016 that would prohibit the Consumer Financial Protection Bureau from regulating payday loans for two years.

“From May to July 2016, Henry Cuellar advised and pressured U.S. Official-3, a high-ranking Executive Branch official with responsibility for the supervision of banks, to take official acts benefitting Foreign Bank-1,” the indictment states.

This included co-signing a letter with seven other members of Congress explaining the negative economic consequences of de-risking and pressuring for new, clear guidance about risk management.

The indictment said he also met with a senator and the high-ranking official about the subject and later told the bank executive that the meeting went well.

“On September 30, 2016, Henry Cuellar sent Executive-1 an email in which he took credit for influencing U.S. Official-3’s approach to correspondent banking and de-risking issues, stating: ‘Our meeting with [Senator-1] and [U.S. Official-3] is moving the discussion the [sic] right direction. Un abrazo,’” the indictment states.

Federal prosecutors say another of the bank’s executives on Nov. 23, 2018 sent him a document accusing one of the bank’s competitors of laundering proceeds from drug trafficking, kidnapping, extortion and terrorism financing operations.

“On August 14, 2019, Henry Cuellar sent two emails to Executive-2 containing the text of S.1883, the Combating Money Laundering, Terrorist Finance, and Counterfeiting Acts of 2019, along with a one-page summary of the bill and a section-by-section explanation,” the indictment states. “The bill made various revisions to strengthen criminal statutes and enforcement authorities relating to money laundering, terrorist financing, and counterfeiting.”

The Cuellars deny the allegations and said they tried to meet with prosecutors.

“Furthermore, we requested a meeting with the Washington D.C. prosecutors to explain the facts and they refused to discuss the case with us or to hear our side,” he said in a statement.

He is running for reelection.